Campaign with us

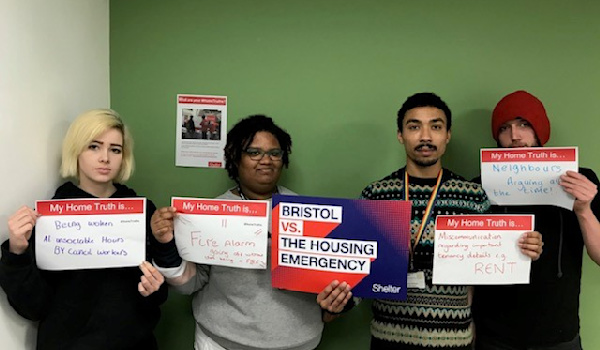

We campaign tirelessly to fight the devastating impact the housing emergency has on people and society. By working with communities to understand the challenges they face, we strive to change the housing system from the ground up.

Support us by writing to your MP, signing our petitions, joining your local campaign, or becoming a Housing Emergency Response Operative (HERO). Your voice is powerful.

Take action

Signing a petition takes less than a minute but can make lasting changes to law

Prioritise the housing emergency at the next general election

Support rights for renters

Demand more social housing

What we're fighting for

We believe home is everything. Your campaigning forces those in power to sit up and take notice, making the changes we need to see to end the housing emergency.

Better rights for renters

An ended housing emergency

Other ways to campaign

We're building an army of campaigners to join the fight for home. We've got big problems to tackle and we need campaigners to join the fight.

Join a local campaign

Be a housing campaigns HERO

Share your story

Our successes

Get in touch

Looking for campaigning resources? Have a question? We'd love to hear from you.