No Help to Buy for England’s average renters

Posted 03 Sep 2019

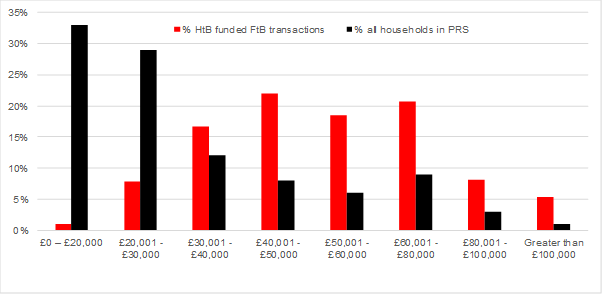

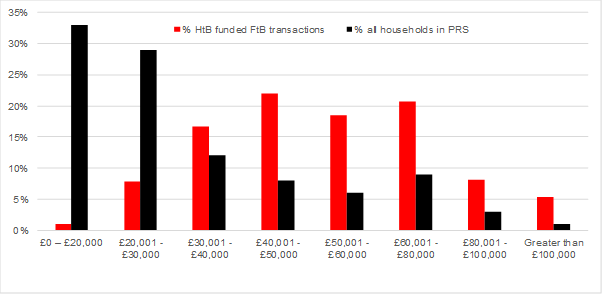

New analysis from Shelter reveals how far out of reach the government’s Help to Buy scheme is for those on typical incomes. Only 4,142 households with incomes of £30,000 or less used Help to Buy in the last year - representing fewer than 0.2% of England’s private renting households in this income bracket.

According to the government’s latest English Housing Survey, the average private renting household has a gross annual income of £27,000. Whereas the average first-time buyer accessing Help to Buy has gross earnings of at least £50,000 - a staggering 85% higher.

Today’s research clearly demonstrates that, while helping a minority of high earners onto the housing ladder, the flagship policy has done little for the vast majority of private renters looking for a stable home. Furthermore, Shelter is critical of the recent announcement to extend mortgage terms for Help to Buy beneficiaries, arguing this will simply leave people in debt for longer while doing nothing to address the shortage of genuinely affordable homes.

The charity’s analysis also looks at the growth in pre-tax profits of the country’s three largest developers (Persimmon, Barratt and Taylor Wimpey) since the introduction of Help to Buy in 2013. All three have managed to more than double their reported profits in under six years, with Barratt seeing the greatest profit rise of 325%.

Interestingly, this growth appears not to be driven by building more homes but due to an upsurge in the profit made on every property sold. For example, Barratt, now makes £53,542 profit per unit on average, compared with the £14,053 it made in 2013. This is despite only increasing the number of homes it has built by 12%.

Shelter is calling on the new government to shift its focus onto social housing by investing in a new generation of genuinely affordable and secure social rent homes, which are linked to local incomes.

Polly Neate, chief executive at Shelter, said: “Help to Buy is often touted by the government as a major success, when in truth it’s a major failure. It’s a policy that boosts the bank balances of big developers but has nothing to offer the average renter.

“The problem with the latest changes to Help to Buy is they’ll take already expensive homes and offer to spread out the costs over a longer period, which perversely ends up with the buyer paying more. Given there are millions of people who can barely afford to keep any kind of roof over their head, this piecemeal approach is never going to solve the housing emergency.

“At the crux of this crisis is the desperate shortage of genuinely affordable social homes. In fact, three million more social homes are needed in the coming years. This is where the new government should be taking decisive action, and where the greatest opportunity to help trapped renters lies.”

Case study: Sylvia, 42, shares a one-bedroom flat with her two daughters, who are aged 12 and six, in Greenwich. Despite earning a salary of more than £35,000 a year, Sylvia sleeps on her sofa while her daughters have the only bedroom.

“Although my flat is nice, I need two bedrooms really as my girls are sharing a double bed and I have to sleep on the sofa. My dream is to buy somewhere one day but at my age it’s scary - even coming up with even a 5% deposit feels impossible.

“I’d love to help my children and save whatever I can and put it into bank accounts I’ve opened in their names, so they’ve a hope of buying one day or going to university. I want them to have a better future.”

Notes to editors:

Data on Help to Buy transactions by income bracket, are compared with the most recent data on household incomes in the private rental sector (drawn from the published datasets for the English Housing Survey (EHS) 2017-18).

The analysis of Help to Buy uses the transaction data for 2018-19 and focuses on first time buyers only. Help to Buy statistics report gross income for the household, regardless of how many members of that household are making the purchase. The incomes of households privately renting are based on the latest available data from the English Housing Survey (EHS 2017-18). This is the gross earnings of the household representative person and their partner (if there are multiple adults in the household).

The following table shows the data in the chart above and includes the EHS estimates of household numbers by income, and likelihoods of accessing Help to Buy.

| Household Income | Number of First Time Buyers using Help to Buy (18-19) | % | Number of PRS Households | % | Ratio ofFirst Time Buyers usingHtB: PRS Households |

|---|---|---|---|---|---|

| 0 20,000 | 479 | 1% | 1,493,894.16 | 33% | 1:3,119 |

| 20,001 - 30,000 | 3,663 | 8% | 1,290,181.32 | 29% | 1:352 |

| 30,001 - 40,000 | 7,617 | 18% | 525,126.43 | 12% | 1:69 |

| 40,001 - 50,000 | 9,764 | 23% | 348,575.30 | 8% | 1:36 |

| 50,001 - 60,000 | 7,818 | 18% | 271,617.12 | 6% | 1:35 |

| 60,001 - 80,000 | 8,309 | 19% | 421,006.54 | 9% | 1:51 |

| 80,001 - 100,000 | 3,230 | 7% | 131,281.61 | 3% | 1:41 |

| Greater than 100,000 | 2,279 | 5% | 45,269.52 | 1% | 1:20 |

| All properties | 43,159 | 4,526,952 | 0.114583333 |

For the purposes of determining the likelihood of a PRS household using Help to Buy we have assumed all Help to Buy first time buyers were previously private renters. In reality a proportion of Help to Buy first time buyers will be newly forming households or potentially social renters – this means our analysis if anything overestimates likelihood of private renters using Help to Buy in any given year.

Help to Buy offers an equity loan to applicants buying newly built homes from authorised developers. Buyers must have a minimum of a 5% deposit for the new home and can borrow up to 20% of the value of the sale (40% for London sales) up to the value of £600,000. Help to Buy agents cannot agree a sale if the buyer pushes their monthly repayment to more than 45% of their net household income. And Help to Buy mortgages must not exceed more than 4.5 times the household income.

The table below presents estimated Help to Buy buyers budgets for London and the rest of England as a whole. According to Bank of England data mortgage advances are typically 3.6 times household incomes. These results illustrate that, given the mean house prices for England and London respectively, Help to Buy is far more viable for those on much higher incomes; incomes which only a minority of renting households earn. As of June 2019, average house prices in England are £246,728, and £466,824 in London.

| Mortgage at 3.6 xIncome | Household Income | England | London | ||||

|---|---|---|---|---|---|---|---|

| 5% deposit | 20% equity loan | Potential home buyingbudget using HtB (mortgage + deposit + loan) | 5% deposit | 20% equity loan | Potential home buyingbudget using HtB (mortgage + deposit + loan) | ||

| 20,000 | 71,613 | 4,774 | 19,097 | 95,484 | 6,510 | 52,082 | 130,206 |

| 30,000 | 107,420 | 7,161 | 28,645 | 143,226 | 9,765 | 78,123 | 195,308 |

| 40,000 | 143,226 | 9,548 | 38,194 | 190,968 | 13,021 | 104,165 | 260,411 |

| 50,000 | 179,033 | 11,936 | 47,742 | 238,710 | 16,276 | 130,206 | 325,514 |

| 60,000 | 214,839 | 14,323 | 57,290 | 286,452 | 19,531 | 156,247 | 390,617 |

| 70,000 | 250,646 | 16,710 | 66,839 | 334,194 | 22,786 | 182,288 | 455,720 |

| 80,000 | 286,452 | 19,097 | 76,387 | 381,937 | 26,041 | 208,329 | 520,823 |

| 90,000 | 322,259 | 21,484 | 85,936 | 429,679 | 29,296 | 234,370 | 585,925 |

| 100,000 | 358,065 | 23,871 | 95,484 | 477,421 | 32,551 | 260,411 | 651,028 |

Developer profits have been taken directly from the published annual, and half year reports (2019 only). The analysis of their profits uses the nominal values of the profits reported (so does not account for inflation across the reporting period analysed.

| Overall | 2019 | 2013 | ||

|---|---|---|---|---|

| Increase in Profits | Increase in supply | profit per unit | profit per unit | |

| Persimmon | 209% | 32% | 67,155 | 28,591 |

| Barratt | 325% | 12% | 53,542 | 14,053 |

| Taylor Wimpey | 123% | 12% | 45,834 | 22,948 |

The 2019 profit value has been taken from the half year results, because these represent 6 months of activity, we have doubled the profit and supply values to make our year on year profit and supply growth values.